Blockchain is an exciting new technological innovation that holds great potential to revolutionise the way businesses and individuals operate today and into the future. In its most basic form, the blockchain automates transaction and record-keeping processes to create a public ledger that is instantly available for everyone to see. This is all done in a decentralised manner, meaning many of the traditional issues and constraints associated with centralised systems have been eliminated.

“What the internet did for communications, I think Blockchain will do for trusted transactions.” - IBM CEO Ginni Rometty

Bitcoin and other cryptocurrencies have been the earliest adopters of the blockchain; however, they only scratch the surface of the potential for this technology. Its most prominent functionalities include:

- Timestamping and notarisation: this function allows the storage of any kind of valuable information within the blockchain, creating a permanent record.

- Smart contracts: software that runs exactly as programmed but with no possibility for downtime, censorship, fraud or third-party interference, and can implement logic to cryptocurrency transactions.

- Defi: DeFi is short for “decentralized finance,” an umbrella term for a variety of financial applications in cryptocurrency or blockchain geared toward disrupting financial intermediaries.

- Tokenisation of Assets: The tokenization of assets refers to the process of issuing a blockchain token (specifically, a security token) that digitally represents a real tradable asset.

- NFT’s: Non-fungible tokens or NFTs are cryptographic assets on blockchain with unique identification codes and metadata that distinguish them from each other.

CRYPTOCURRENCIES AND CRYPTO TOKENS

A cryptocurrency is a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, control the creation of additional units, and verify the transfer of assets. A cryptocurrency gains its value from broad adoption as a legitimate method of payment, its utility, or intrinsic value through limited supply.

A utility token is similar to a cryptocurrency but is usually created to perform a specific utility function related to a blockchain project. A utility token gains its value from the anticipated growth of the underlying project leading to increased demand for the token.

WALLETS

All cryptos (currencies and tokens) are stored in wallets. A wallet is simply a pairing of two uniquely generated, cryptographically linked keys that gives you access to your digital assets.

KEYS

The two keys that make up each wallet are a Private (or secret/withdrawal) key and a Public (or share/deposit) key. These keys facilitate and secure each crypto transaction.

Simplistically, think of your Public key like your bank account number and your Private key as your PIN.

WALLET TYPES

The Ainslie Crypto Wallet is a cold/offline paper wallet provided free of charge with any purchase. The computers and printers used to create the wallets have never been online. Random number generators are also used to add another level of security around key generation. Ainslie wallets are only produced while you watch so you can oversee the security around each stage of the process. Ainslie Storage Accounts are held on these also and have already been secured at the Reserve Vault before being issued.

A hot wallet is any wallet that has been exposed to a device that has been connected to the internet, meaning that potentially your private key could be compromised if your device is not completely secure.

A cold wallet, on the other hand, has no online footprint. This can be in the form of a “paper wallet” that was generated completely offline or a hardware wallet where the private key is secured by a physical device that can only be accessed by the owner.

Wallets that are stored online by a third party, often an exchange, can be the most convenient for short-term traders looking to make quick buys/sells. This is potentially the least secure method of storage, however, as your assets are not under your personal control. Most large hacking incidents where significant funds have been stolen have occurred on exchanges.

DIGITAL MONEY & DIGITAL UTILITY

The differences between cryptocurrencies and utility tokens were outlined earlier. At the time of publication, some of the top cryptos by market capitalisation were Bitcoin, Ethereum and XRP. With these examples, the ''money'' versus ''utility'' equation can be explored further. Also, we have asset-backed stable coins which can also fall in the category of traditional 'digital money' – for example, Tether (USDT).

BITCOIN

Bitcoin (BTC) is often referred to as the “King of Crypto”, being the first and currently the most valuable coin in terms of market capitalisation. BTC has remained the reserve currency in the crypto space due to its continued dominance in market cap, media attention and liquidity for transferring between other alternative cryptos. Its supply is constrained to only 21 million units and the remaining BTC which hasn’t been minted yet can only be created through a complex, laborious and expensive “mining” process, which also ensures the security of the network.

BTC is a genuine cryptocurrency as it was created to allow direct, trust-less peer-to-peer payments. However, BTC has moved away from its intended purpose of being a peer-to-peer payments network towards a 'store of value'. It's beginning to gain popularity as the go-to asset in the traditional world for an inflation hedge as companies such as Tesla and MicroStrategy add BTC to their balance sheets.

ETHEREUM & RIPPLE

Ethereum (ETH) and Ripple (XRP) differ from BTC as they are considered to be utility cryptos, rather than pure cryptocurrencies. Ethereum is an open-source, distributed computing platform and operating system featuring smart contract functionality. It allows developers to build blockchain applications using the platform. ETH is the token that operates as the “fuel” for the Ethereum engine, particularly for DeFi and NFT applications.

XRP (colloquially often just called Ripple) has utility via its ability to operate as a purpose-built fiat currency settlement and foreign exchange network. It aims to revolutionise the 40-year-old traditional banking and SWIFT payment system. XRP is the token native to the Ripple network and plays a pivotal role in providing liquidity to accommodate foreign exchange transactions.

What is DeFi?

DeFi is short for “decentralized finance,” an umbrella term for a variety of financial applications in cryptocurrency or blockchain geared toward disrupting financial intermediaries via smart contracts. Smart contracts automatically execute transactions if certain conditions are met. For example, say a user wants his or her money to be sent to a friend next Tuesday, but only if the temperature climbs above 30 degrees according to weather.com. Such rules can be written into a smart contract.

DeFi aims to give users an alternative to the traditional financial systems by removing the need to trust centralised parties. This is achieved by building digital services in an open, permissionless, and decentralised manner. By removing the intermediary and automating many functions of the traditional institutions, DeFi can provide lower costs, higher degrees of security and privacy, resist censorship, increase accessibility and promote a decision-making democracy.

Most applications that call themselves DeFi are built on top of Ethereum. Examples of DeFi use cases include Decentralized exchanges (DEXs), Stable coins, Lending platforms, prediction markets and yield farming.

What are NFTs?

A non-fungible token is a special type of cryptographic token which represents something unique. NFTs are called non-fungible because they are not mutually interchangeable since they contain unique information, although it is possible to mint any number of NFTs representing the same object. Perhaps, the most obvious benefit of NFTs is market efficiency and known scarcity. The conversion of a physical asset into a digital one streamlines processes and removes intermediaries. NFTs representing digital or physical artwork on a blockchain removes the need for agents and allows artists to connect directly with their audiences.

Examples of an NFT is digital artwork, baseball cards and even NBA moments in a digital card form.

THE GOLD & SILVER STANDARD

Ainslie Crypto has created the Gold Standard (AUS) and Silver Standard (AGS) tokens. These ERC-20 compliant stable coins are 100% backed by fully allocated gold and silver bullion, respectively. That metal is already secured in Reserve Vault, verified quarterly by global assurance firm BDO, and insured by the world’s leading insurer. Each token (to 4 decimal places) represents 1 gram of either gold or silver and are fully redeemable for bullion. AUS and AGS are not securities allowing unrestricted trade and are currently available through Ainslie Wealth (OTC), CoinSpot (24/7 exchange), Metex (Open order book exchange from anywhere ex USA), Elbaite (true peer to peer trading with trusted escrow payment intermediary)) and Bamboo (dollar-cost averaging, auto-debit and round up application).

WHY BUY CRYPTO?

DIVERSIFICATION OUT OF FINANCIAL MARKETS

Ainslie's trademark tag line is "balance your wealth in an unbalanced world". When talking about balance, it is important to remember the principle that true diversification is best achieved with uncorrelated assets. In this regard, crypto has a similar value proposition to precious metal bullion, with some of its unique properties.

Cryptocurrency has demonstrated, throughout its relatively short existence, to have a limited correlation with established financial or property markets. In many ways this makes sense as the entire premise of crypto involves creating decentralised value outside of existing frameworks. Whilst timing will always remain unclear, another financial crisis in the future is inevitable. In that case, if you are trying to protect yourself against a failure of the financial system, then, of course, owning assets outside of that system makes the most sense. For example, during 2020 as the Coronavirus crisis unfolded and the central bank's printed record amounts of cash, Bitcoin ended the year up 350%.

THE CRYPTO ADVANTAGE

DECENTRALISATION

As crypto is managed by the network and not one central authority, it is open to everyone. There are approximately 1.7 billion individuals with access to the Internet or mobile phones who don't currently have access to traditional banking systems. Banking is just the first of many possible use cases for blockchain-based technology.

SETTLEMENT EFFICIENCY

In most of today's business dealings, brokers, agents, and legal representatives can add significant complication and expense to transactions. There's paperwork, fees, special conditions and other obstacles that make the process less efficient. Crypto overcomes this with algorithmic certainty, greater accountability and transparency.

LOWER FEES

Compared to regular bank and credit card transactions, crypto offers similar services at a fraction of the cost. By eliminating “the middle man” from the process, crypto networks can facilitate exchanges with significantly lower fees.

CONTROL

Once a crypto transfer has been authorised, it can't be reversed as in the case of "chargeback" transactions allowed by credit card companies. Credit cards operate on a "pull" basis, where the store initiates the payment and pulls the designated amount from your account. Crypto uses a "push" mechanism that allows the owner to send exactly what they want to the merchant or recipient with no further information.

SECURITY AND PRIVACY

Cryptography secures the records in a blockchain using algorithms and distributed nodes to deliver one of the most secure digital capabilities ever created. In addition, crypto transactions are discreet. Unless a user voluntarily publishes their details, records are never associated with a personal identity, much like cash-only purchases.

NO COUNTERPARTY RISK

With crypto, you own the private key and the corresponding public key that makes up your wallet address. No one can take that away from you. There is no other electronic cash system in which your account isn't owned by someone else. This, as well as a known and fixed supply, protects your personal control in the event of economic instability outside of the financial system.

UNIVERSAL RECOGNITION

Since crypto is not bound by the exchange rates, interest rates, or other charges of specific countries, it can be easily used internationally for business and travel.

SMART CONTRACTS

Smart contracts built upon the foundation of the blockchain present an exciting opportunity for the future as computer protocols replace legacy systems with digitally facilitated, verified and enforced contracts and applications.

TECHNOLOGICAL INNOVATION AND ADOPTION

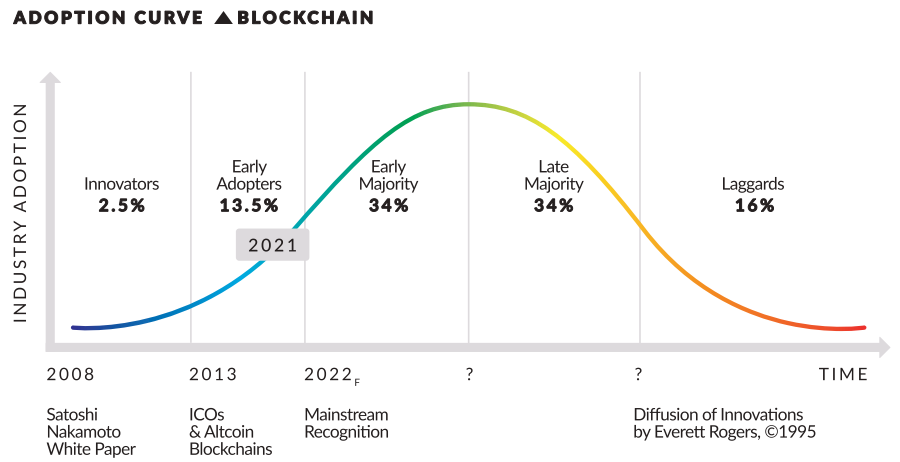

It is quite likely that blockchain technology is still in the early stages of its overall adoption cycle. Institutional players, such as banks, are only just beginning to explore the potential of the opportunity by running private (permissioned) crypto solutions until regulation or legislation catches up to the technology, and capital markets are confident in the types of services they can offer. This creates a significant opportunity for early adopters as we see a whole new asset class emerge.

Over the past 12 months, the growing maturity of the crypto market has been validated with a plethora of new products coming into the space. These products include derivatives, borrowing, lending and most importantly custody solutions. With the likes of Fidelity Digital Assets and Goldman Sachs moving into the space, it’s only a matter of time until an ETF is approved.

CBDC’s

A central bank digital currency (CBDC) uses a blockchain-based token to represent the digital form of a fiat currency of a particular nation (or region). A CBDC is centralized; it is issued and regulated by the competent monetary authority of the country.

CBDCs might not have been the original idea of blockchain and crypto, but the continued development of them is good news for blockchain and crypto adoption. It's important to remember that Central Banks love to print money and it's almost a certainty that they will create a digital currency without a supply limit. Much to the contrary, crypto-assets such as bitcoin have a supply limit.

As the world moves all finances to the digital space, it's going to be even more prevalent to own inflation hedging assets such as bitcoin, precious metals and even gold and silver-backed cryptos such as our AUS and AGS tokens.

EMBRACING VOLATILITY

There is no denying that throughout its brief existence crypto has experienced a wildly volatile ride. Just because a market is erratic, does not mean it is unhealthy. History has proven, time and time again, that risk is more closely associated with ignorance than unpredictable movement. Historically, the nature of crypto only introduced risk if you took a short-term perspective and panic sold on a dip. Normally we would preach the traditional rule of taking a long-term view with any investment. There are opportunities for astute investors to "play" the volatility crypto provides to their advantage, with appropriate trade windows. Ainslie offers the added benefit of being able to "park" your crypto in bullion between trades.

The chart below shows the potentially advantageous volatility of Bitcoin in comparison to the relative stability of Gold and the S&P 500. It also depicts a lack of correlation, which is highly desirable for investors seeking the safety of unrelated asset classes.

HOW TO BUY CRYPTO

One of the most significant hurdles for people looking to gait n exposure to crypto is the difficulty of purchasing the digital asset with fiat currency (AUD), given the limits, delays and understanding necessary to purchase safely online. Ainslie provides a unique solution to this problem by creating a simple, secure, certain and streamlined process for purchasing and storing crypto. We allow you to buy, sell and trade crypto for cash or bullion at our Brisbane office, by phone or through our webshop. There is a minimum $2,000 transaction per crypto. Ainslie currently sells Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin, USDT, AUS, AGS, and six other large market cap alt-coins. We can also help you purchase any other cryptocurrency; all you have to do is ask (minimum $5000 transaction).

HERE ARE THE STEPS FOR BUYING:

- Place your order online, in-store, phone, email

- We generate an indicative order showing the total due

- You pay us

- On cleared funds we lock in your final price and transfer the crypto to you, to either:

- A new Ainslie Crypto Wallet: produced in front of you in our store and provided free of charge – you also receive a PDF backup of your keys on a secure USB

- Your own existing wallet: if you have your own wallet already, we can simply send your crypto to that address when provided and you don't need to come into our office

- An Ainslie Storage Account wallet: we manage the entire process for you with Ainslie Crypto Wallets pre-produced and already stored securely at the Reserve Vault.

If you want to sell, we’ll sweep your paper wallet or you can send us the crypto you want to sell for cash or use to buy bullion.

DIGITAL ASSETS IN YOUR SMSF

IS CRYPTO ALLOWABLE IN YOUR SMSF?

Crypto is an allowable asset in your Self-Managed Super Fund provided you set up your fund correctly to contemplate its inclusion and then purchase and sell it in an acceptable manner. Ainslie offers a fully compliant means of buying and selling within your SMSF; indeed, a very large portion of our crypto customers are SMSFs.

HOW TO PURCHASE CRYPTO FOR YOUR SMSF

Purchasing crypto for your SMSF is as simple as the personal process outlined previously with the one additional requirement for the provision of the front and signing page of your SMSF deed and identification for all trustees/directors.

You will receive an invoice showing the SMSF entity as the purchaser, exactly what you bought, the price paid, and importantly the address of the wallet to which it was sent. You need to ensure you don't mix personal and SMSF transactions on that wallet.

When an audit is required, the auditor simply searches the blockchain for your address, confirming that it matches your purchases, and applies the price on that day (we provide historical prices on the 30th of June on our website each year for added convenience). As the blockchain is a public ledger there is no asset more transparent than crypto when managed in the way we suggest.

Your SMSF manager or accountant may be more comfortable with you using one of our Ainslie Storage Accounts. With this option, we ensure only the SMSF entity can trade that account and you get a certificate of holding. It is held securely in Reserve Vault, and on the 30th of June, we can provide a statement of holding and value for the audit. Simple!

CLUELESS ABOUT CRYPTO?

Bolster your crypto vocabulary with a few key terms:

- Altcoin – An altcoin refers to any crypto other than Bitcoin.

- Blockchain – Blockchains offer decentralised records that are encrypted and stored across thousands of devices across the globe rather than by one centralised governing body.

- FOMO – An acronym for 'Fear of Missing Out'. A common phrase used within the crypto community to refer to the overwhelmingly positive sentiment towards a coin that causes individuals to irrationally buy with a lack of research.

- Fork – The event in which a new blockchain is created, using the existing software code of the old blockchain but with new improvement (BTC – BCH for example).

- FUD – An acronym for ‘Fear, Uncertainty and Doubt’. A common term used within the crypto community to describe unjustifiable negativity towards a coin or offering.

- ICO – Acronym for 'initial coin offering' – similar to an IPO in the share market. An ICO is when a crypto start-up issues its own token as a method of crowdfunding the particular project. Usually, these are funded with other cryptos such as Bitcoin or Ethereum.

- Market Cap – The total, accumulative value of a cryptocurrency. The total figure is calculated by multiplying the total supply of a token by the value of each token.

- Mining – When an individual offers their computing power to decrypt blocks on the blockchain to process transactions. Miners are generally rewarded with an amount of crypto-based on their contribution.

- Node – A device that keeps a copy of a blockchain, utilising computing power to maintain the integrity of transactions.